As countries around the world move towards a low carbon future and attempt to reduce their dependence on fossil fuels, the demand for other natural resources that are essential to achieve ambitious climate change targets intensifies. Metals and minerals supply chains will be under heavy pressure to meet those demands.

Last year the World Bank estimated, in its “Minerals for Climate Action Report”, that over three billion tonnes of minerals and metals will be needed for the transition to renewable energy sources and low emission forms of transport, to meet the below 2°C targets for reducing global warming.

However, with so many of the world’s economies striving towards the same objectives and supply sources often developing slowly, procuring the materials needed is becoming more of a concern.

The demand for these metals comes not only from the EV industry, but from many other up and coming industries as well. Batteries that power electric cars need cobalt, nickel and lithium, but so do the batteries that store the power generated by renewable energy systems – and the infrastructure which generates that energy. Wind turbines, solar farms, hydroelectric plants all need significant amounts of metal to support their expansion. Meanwhile, research into the potential for other materials to enter the battery technology race, such as lead and zinc for stationary energy storage, could also see the need for these metals by this sector increase.

The supply chains for these metals and minerals will be the vital arteries of the future economy, as important as the oil pipelines of today. And it’s not only mining capacity which needs to evolve to support them, but also the refining facilities and gigafactories that process these raw materials. Without significant intervention and support to develop the world’s supply chains of these materials, supply constraints and price spikes are in view and threaten the momentum towards greener technologies.

The effects are already in play. Volatility, and, in many cases, the cost of buying metals for these new technologies has been rising for some time.

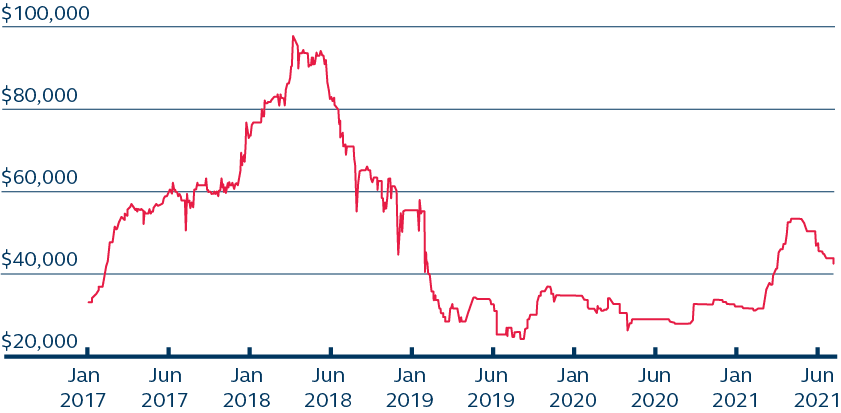

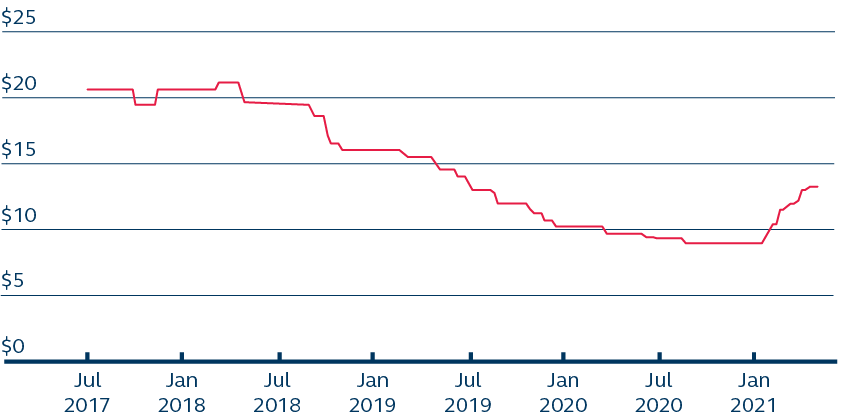

Cobalt

Cobalt surged 70% on the London Metal Exchange in 2017, after jumping 37% in 2016, and peaked again in 2021 with a 14-month high of $52,700 per tonne in March. With battery demands increasing, Benchmark Minerals Intelligence forecasts a global deficit of 216,000 tonnes of cobalt in 2030, while MIT research suggests that in the next decade, cobalt production capacity will need to increase by 1.6 times to meet global demand.

LME Cobalt Cash Price, US$ per tonne

Source: LME.com

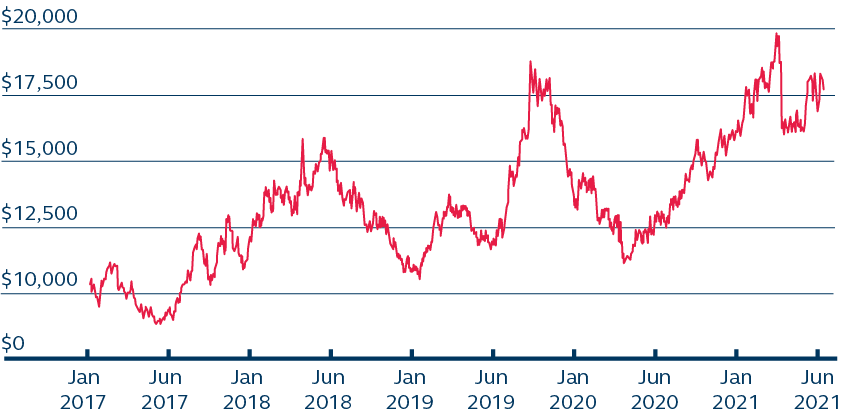

Lithium

Lithium prices have seen extended gains in recent months and nickel reached-a seven-year high of $19,689 per tonne in February 2021. Experts forecast that the battery sector is likely to drive a six-fold increase in demand for the material by 20301. Lithium’s story is reminiscent of that of oil a century ago. In fact, both elements enjoyed a quiet existence at the margins of the global economy for a long time, until technological breakthroughs catapulted them to the forefront of a mobility revolution. As the internal combustion engine powered the global economic growth and development of its time, so EVs can help achieve a more sustainable model of development and help to control global warming.

Fastmarkets lithium hydroxide monohydrate 56.5% LiOH.H2O min, battery grade, spot price cif China, Japan & Korea $/kg (midpoint)

Source: Fastmarkets

Nickel

The price of nickel reached a six-year high on the LME in February 2021, after climbing steadily throughout 2020. This was due at least in part to a rise in post-lockdown demand, particularly from reopening steel mills and uncertainty around short term supply. The last peak in 2019 was largely driven by supply concerns, with fears that Indonesia’s ban on exports would lead to future supply constraints.

While nickel consumption by the battery sector is still small – around 6% of total global consumption – and some forecasts suggest this could grow to 18% by 2025, and 25% in the next 10 years2.

LME Nickel Cash Price, US$ per tonne

Source: LME.com

Even more “traditional” metals do not escape this hike in demand. Copper prices, for example, are at 10-year highs. The red metal is an essential element in electric vehicles, which contain around four times more of the metal than regular vehicles. Demand is also increasing for use in renewable energy systems, often requiring new transmission lines and infrastructure, and for the world’s planned EV charging station network.

According to a study by the World Bank3, the amount of copper required to supply this demand from new low carbon technologies through to 2050 will be the same as has been produced in the last 5000 years. This huge demand increase will require new mining capacity to be developed to ensure sufficient supply. However, it can take decades between finding a promising copper deposit in the ground and producing the metal at scale, which will likely require further smelting and refining capacity as well to process the ores into high grade metal.

The issue of developing mining supply rapidly may point to a future that is more sustainable, however. Given the right combination of economic incentives and technological breakthroughs, the recycling industry could step in, at least partially, to fill the supply vacuum and prove to be vital if it can extract and re-use elements like lithium, cobalt and other metals from batteries and from the EVs themselves. The evolution of the circular economy for aluminium, copper and steel will be vital in the effort meet the demands of the coming years.

This new vision for the automotive industry does not take place in a vacuum and its dependencies will create risks in the supply chain. Understanding its impact on price, value and availability will require a marketplace that offers price discovery, liquidity and futures contracts that reflect the real world as well as offer value to the financial one. The LME is here to deliver exactly that.

1 Source: Wood Mackenzie ‘Future energy – how electric vehicles transform battery demand’

2 Source: Fastmarkets ‘The many forces driving nickel price volatility’

3 Source: The World Bank ‘Climate Smart Mining – The Growing Role of Minerals and Metals for a Low Carbon Future’

Published June 2021